Pre-approval letters in Chicago real estate deals really don’t mean anything. There, I said it.

Pre-approval letters in Chicago real estate deals really don’t mean anything. There, I said it.

I’ll say it again. Pre-approvals don’t mean a thing. I know it is hard to believe, but it’s true. I probably average one telephone call a month from a confused seller-client who wants to know why the buyer needs a mortgage contingency extension when “they were already pre-approved”.

Here is a secret. A pre-approval letter is not an approval. In fact, the entire home mortgage banking process is littered with things that make consumers think they are approved when they are not. “Pre-Approved”; “Pre-Qualified”; “Approved subject to conditions”; “Approved but not clear to close”. None of these are a guarantee that the buyer will get a loan and are really just different ways to say the buyer is NOT APPROVED.

Many buyers, sellers, and real estate agents think that a pre-approval makes an offer to purchase a home “stronger”. I don’t. What is a pre-approval really? Well, in Chicago’s home lending market, it usually means one simple thing: that the buyer placed a call to a mortgage lender and the mortgage lender is willing to try to get the buyer a loan.

Pre-approvals are a great way for mortgage lenders to market their services though. I think most people could pick up the phone and in ten minutes get five pre-approvals faxed to them from five different lenders. Today’s pre-approval letter really just says “prospective borrower, if everything you told me is true and if I don’t find anything wrong with your credit or the place you want to buy, I will give you a loan… maybe.”

In some rare instances, a lender might actually “underwrite” a loan (ie. gather verifications of deposits and employment, pull credit and submit the file to an actual underwriter for review). That sort of pre-approval is a bit better than what most home buyers can produce. But even those pre-approvals are still subject to other conditions like appraisal and condominium review, title, and “quality control” review. The type of pre-approval where a lender actually does all of this is pretty rare in the Chicago lending market.

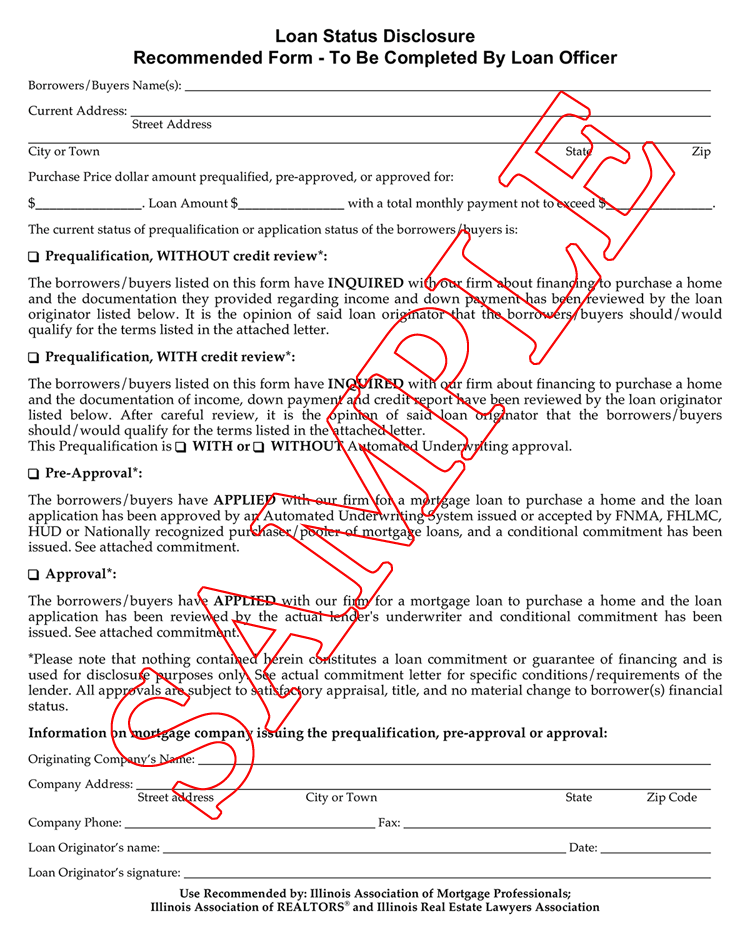

Over the years, the real estate industry has recognized the trouble created by pre-approval letters and has responded with attempts to clarify the situation. The Multiboard 5.0 real estate contract added a final page breaking down the different kinds of pre-approval a buyer might present.

In my experience, the use of this form as part of a “standard” real estate contract is, unfortunately, quite rare. Until lenders stop the practice of issuing a pre-approval to just about anyone who calls, smart sellers would be wise to not put too much stock in that letter as any sort of indicia that the buyer really qualifies.